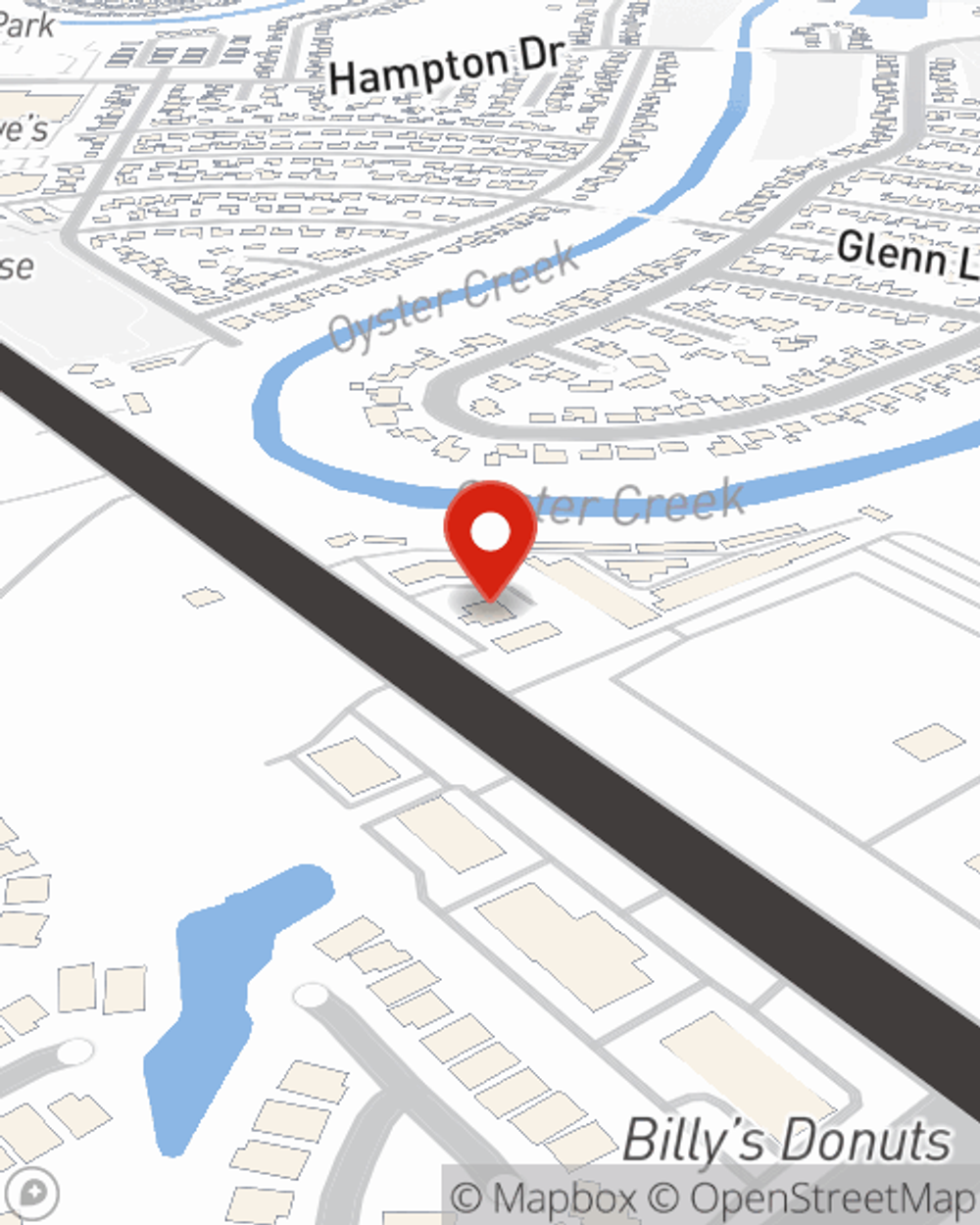

Renters Insurance in and around Missouri City

Looking for renters insurance in Missouri City?

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Fort Bend County

- Harris County

- Missouri City

- Sugar Land

- Rosharon

- Fresno

Protecting What You Own In Your Rental Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented house or space, renters insurance can be the right next step to protect your stuff, including your guitar, tools, sports equipment, furniture, and more.

Looking for renters insurance in Missouri City?

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

Renting is the smart choice for lots of people in Missouri City. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance might cover repairs for a break-in that damages the door frame or tornado damage to the roof, that won't help you replace your possessions. Finding the right coverage helps your Missouri City rental be a sweet place to be. State Farm has coverage options to correspond with your specific needs. Thank goodness that you won’t have to figure that out by yourself. With personal attention and fantastic customer service, Agent Sonia Olivo can walk you through every step to help you create a policy that guards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Missouri City renters, are you ready to see how helpful renters insurance can be? Call or email State Farm Agent Sonia Olivo today to see what a State Farm policy can do for you.

Have More Questions About Renters Insurance?

Call Sonia at (281) 980-5555 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Sonia Olivo

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.